Open Banking & PSD2- Are the Retailers ready to make the move??

Disclaimer : The opinions expressed in this article are my own & doesn’t reflect that of organisations current or past I have been involved with.

Open Banking / PSD2 - What is that??

Open Banking came to effect on the 13th Jan 2018. It was mandated by the UK's Competition and Markets Authority (CMA) in 2016 to the 9 biggest banks in the UK (HSBC, Barclays, RBS, Santander, Bank of Ireland, Allied Irish Bank, Danske, Lloyds and Nationwide) to have the capability to expose the information they hold about their customer in their bank accounts and to provide provision to instruct payments through APIs in a secure and standardised way for other entities like Challenger banks or Fintechs (referred to in the standards as Third Party Providers - TPPs ).

APIs or Application Programming Interface is a mechanism by which one or more IT systems make use of the service offered by another in a pre-defined and standard way. For example, it is the way Uber makes use of Google Maps in its App.

This was aimed at levelling the playing field and promoting innovative products and services for the consumers. For example, the transaction history stored in a customer's bank account is a treasure trove of information like what are their earnings, how much they spend on utilities / Grocery / Insurance / Mortgage etc. This information can be utilised by TPPs to provide meaningful analysis or the TPPs can act as service providers to pay for goods and services. As an example, if you are a multi-bank customer, the TPP could provide a consolidated view of your finances across your different bank accounts.

Though Open Banking superficially looks more like its directed against the big banks, nothing stops the traditional banks from turning the tide by utilising the same capabilities to launch innovative offerings themselves or by partnering with / acquiring other FinTechs.

If that got you concerned about the security and privacy impact, there are 2 aspects to consider. Firstly the TPPs providing these services need to undergo rigorous security and compliance process to be licensed and are regulated by the FCA (Financial Conduct Authority).Apart from this they also need to make sure that they have the proper process and procedures to handle one or more of the likes of GDPR, PCI-DSS etc to name a few.

Secondly, access to customer's data would need informed and explicit consent from the account holder (which can also be revoked at a later point in time) with stronger authentication to prove the higher level of assurance. The consent aspect also has a tie-in with EU GDPR Directive. Hence privacy and security are key underlying requirements as part of this directive.

Opening up the account data and to provide the ability to perform payments also forms part of the EU's 2nd Payment Service Directive (PSD2) which is the latest European legislation on payment standards. One of the key aims for Open Banking was to be compliant with the PSD2 regulation. Interestingly, though the initial scope for Open Banking was only to cover the Personal and Business Current Accounts, the latest change in scope (as of Nov 2017) aligns it closer to the PSD2 scope. i.e cover all payments accounts covered by PSD2 including savings accounts, credit cards, loans, mortgage and even multi-currency accounts. All these additional elements added to the existing scope would start to be implemented in a phased manner running until Aug 2019.

As mentioned earlier, apart from the possibility of account aggregation, PSD2 / Open Banking brings in the possibility for another capability that can be exploited by TPPs - instructing payments on your behalf. So, payments can be made through likes of Facebook messenger / Whatsapp. A more creative application to this might be AI based financial services that can automatically sense that your current account is approaching the minimal threshold balance you had set and automatically move money out of another account of yours held in a different bank into this account... provided you have consented the TPP for this.

The PSD2 directive identifies two types of TPPs - Account Information Service Providers (AISP) and Payment Initiation Service Providers (PISP). AISPs are providers of service that can access customer's bank account on behalf of them and retrieve information for which they have been consented by the customer. Alternatively, PISPs are TPPs that can initiate payment transactions on the customer's bank account for which they have been provided consent. Please note that both AISP and PISP are distinctly defined roles. i.e one cannot do what the other can. Though the same TPP can be registered and licensed to act as both AISP and PISP.

So, What is in it for the Retailers

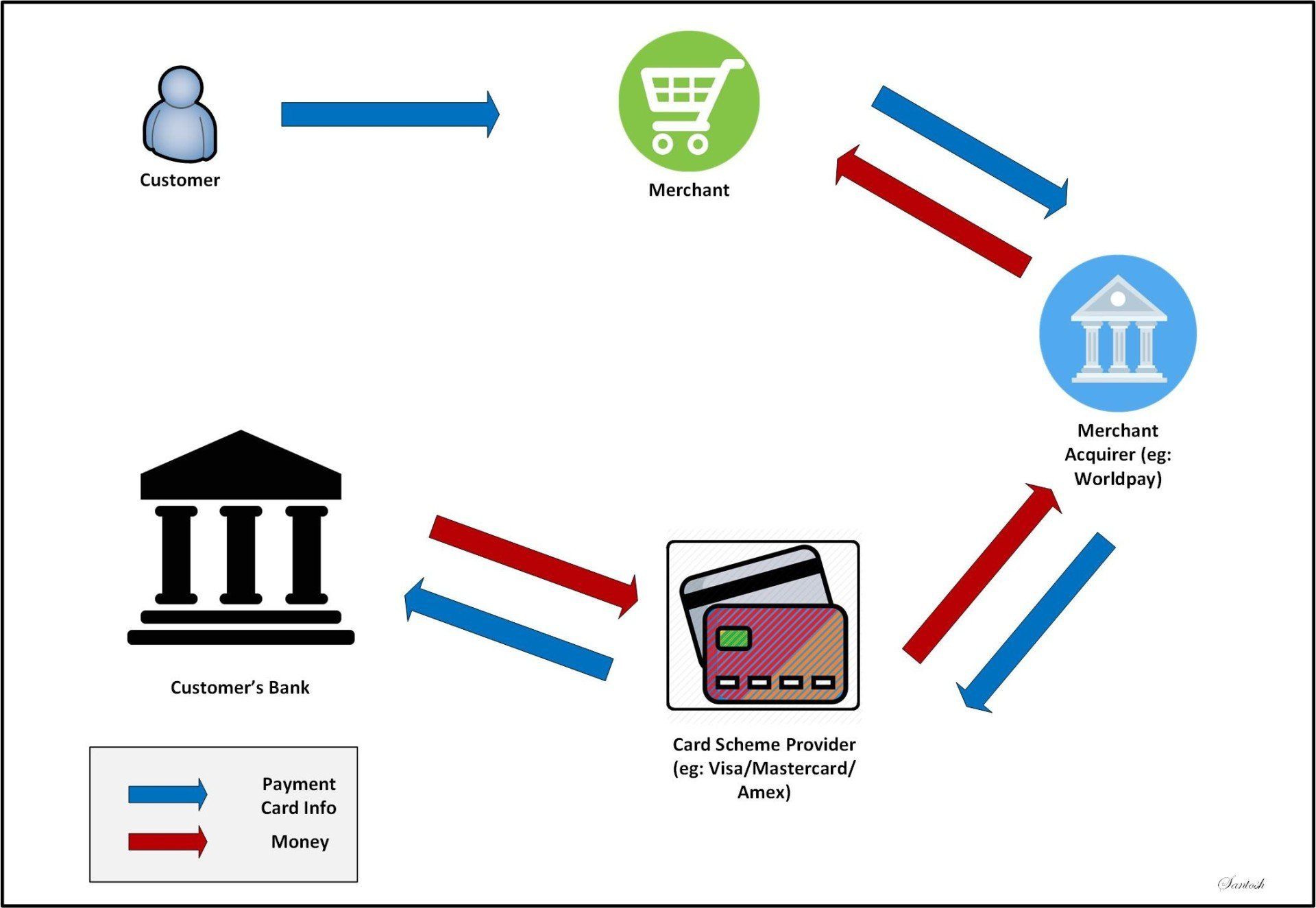

In the current world, when a purchase is made on the Retailer's website using credit/debit card, the retailer's transaction has to go through a series of intermediaries ranging from the acquirer to the card scheme provider etc. A charge is added to the transaction directly or indirectly at every stage. The overall additional charge added is usually in the region of up to 2 - 2.5% of the transaction value in total. With most retailers not able to pass this surcharge to the customer, guess who picks the bill??

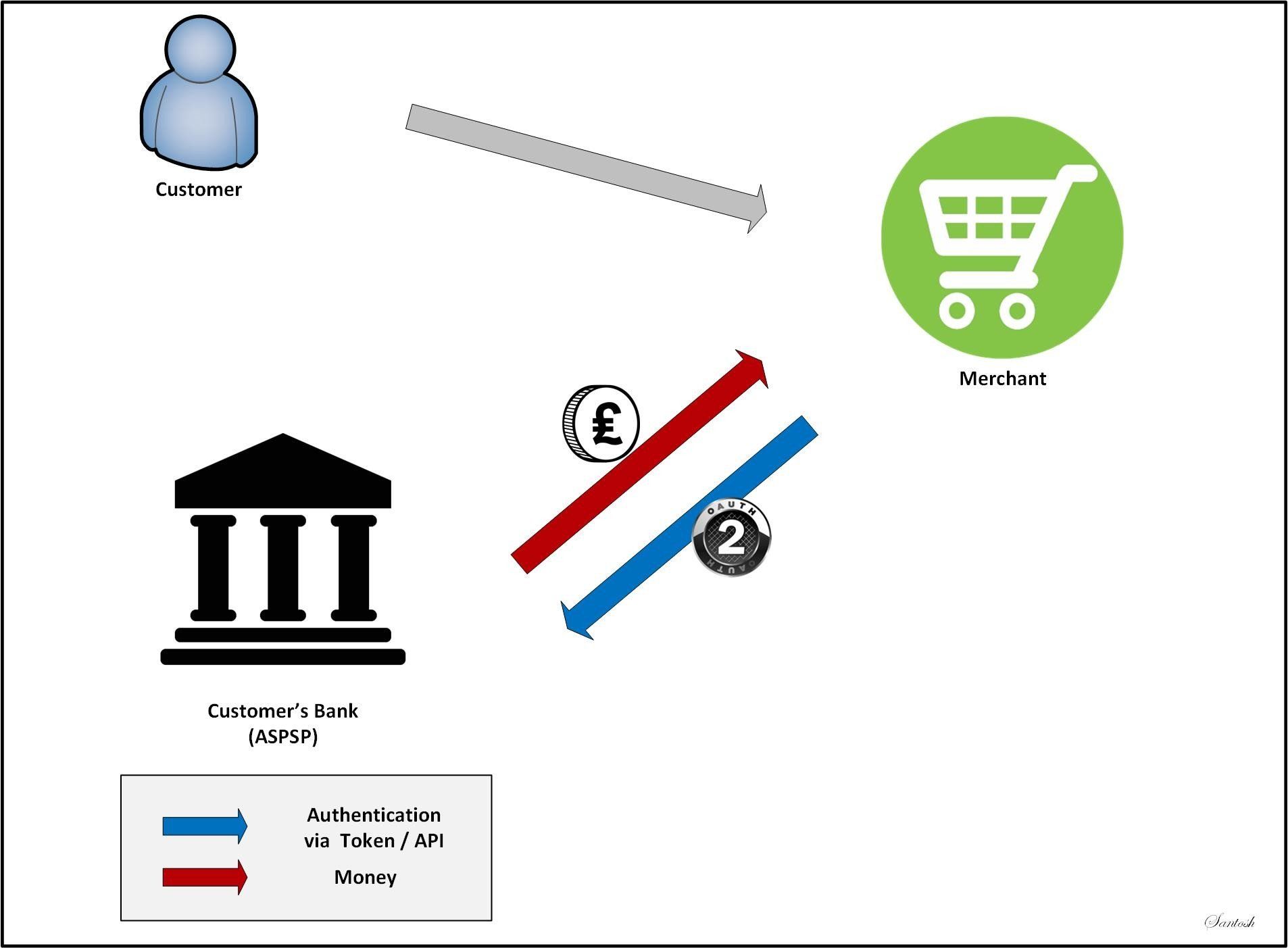

Open Banking / PSD2 provides the option for retailers (if they act themselves as PISPs) large and small to accept payments directly from the customer's financial institution (in PSD2 speak, Account Servicing Payment Provider - ASPSP ) thereby bypassing the intermediaries. This path to payment is also called Access to Accounts or XS2A in short. After purchasing the goods, the customer if they choose to pay through the Open Banking route, selects their bank from the list of banks displayed. They are taken directly to their bank's login screen. The customer's bank authenticates the customer's transaction directly using Strong Customer Authentication (SCA) as mandated by the directive and takes their consent for the payment (including the account to use if they hold more than one) to be made to the retailer.

What is to be noted is, that the customer when using this open banking based service, will not need to share their banking login credentials with anyone but their bank. This equates to reduced transaction cost, increased security and a lesser possibility of fraud.

What more, there are future potentials for retailer yet to be tapped like the possibility of using the transaction data from the customer's account directly used to calculate the retailer's loyalty programme entitlements or to provide faster refund processing (which can have a positive influence over customer loyalty). For the customer, this is a "wallet-free" UX.

What's stopping the online retailers from lining up already to implement this?

Due to the relatively early stages, Open Banking has not yet had the tipping point. As of now, it has been noticed that there is more uptake of this with the GenX & Millennial as against the baby boomers. The key obstacle being the "Trust deficit" of handing over personal banking details to new incumbents using technology new to the customers and the perceived risk of fraud potential hovering in their mind. This is similar to when online banking, mobile banking or mobile wallets were introduced.

In addition, the PSD2 requirements on SCA might initially add a bit of friction to the user experience due to the additional security requirements but the acceptance is expected to start getting better over a period of time when the right balance between security and user convenience is realised or when newer methods of strong authentications (eg: Biometric based) emerge that add lesser friction. I guess as of now, its a matter of personal preference between typing the card details vs logging in with your banking credentials.

It's sure is going to be an interesting period to watch how the early adopters in this area progress...